wells fargo class action lawsuit overdraft

Checking Account Overdraft Litigation MDL No. In a class action lawsuit filed against Wells Fargo Company and Wells Fargo Bank NA.

Wells Fargo Ex Ceo Stumpf Pays 2 5 Million To Settle Sec Charges He Misled Investors Chief Investment Officer

In 2014 a federal judge ordered Wells Fargo to pay 203 million to settle class action allegations against the bank for wrongfully processing debit card transactions in order to charge excessive overdraft fees.

. If you were charged an overdraft fee by Wells Fargo on a debit card purchase within the last year you may qualify for a free Wells Fargo overdraft fee claim review. Wells Fargo Ordered To Pay Over 200 Million In Class Action Lawsuit Over Alleged Unfair and Deceptive Overdraft Fees. This settlement resolves a lawsuit against Wells Fargo Bank NA Wells Fargo Co National General Holdings Corp.

The class includes all present and former holders of demand deposit accounts with wells fargo who were not opted into wells fargos debit card overdraft service at the end of a month in which they were charged an overdraft fee by wells fargo for a debit card transaction with uber or lyft from january 1 2014 to february 28 2018. The financial corporation has found itself facing consumer backlash regarding alleged unfair operations of the bank potential unethical practices and more which have resulted in a range of class action lawsuits being filed. The settlement resolves a class action lawsuit against wells fargo in the united states district court for the central district of california armando.

And Wells Fargo Bank NA claims the defendants have violated Federal Reserve Regulation E by suggesting that their overdraft policies use an. The 36-page lawsuit filed against Wells Fargo Co. Wells fargo class action lawsuit overdraft.

Boston ma accesswire december 16 2020 the thornton law firm announces that a class action lawsuit has been filed on behalf of investors of wells fargo. The Wells Fargo overdraft fee class action lawsuits are consolidated in the Wells Fargo overdraft fee MDL known as In re. Wells fargo claims it has already made some of.

Wells fargo class action lawsuit. Wells Fargo Ordered to Pay 203M in Overdraft Fees Class Action Settlement. A study cited in the decision by a wells fargo witness put the restitution at close to 203 million.

American financial services company Wells Fargo is the fourth largest bank in the United States based on assets. 2010the lawsuit alleged that the defendant bank overcharged the plaintiffs who held deposit accounts at the bank for overdraft fees using a series of deceptive bookkeeping techniques. All Wells Fargo customers from November 15 2004 to June 30 2008 who incurred overdraft fees on debit transactions as a result of the banks practice of sequencing transactions from highest to lowest - will be part of this class action lawsuit.

Attorneys have been speaking with those who used their debit card and was charged an overdraft fee for an everyday regular purchase such as clothing a ride with Uber or travel booking. Get a Free Wells Fargo Overdraft Fee Claim Review. Attorneys have filed lawsuits including a class action against Wells Fargo alleging excessive overdraft fees.

July 13 2021 A class action claims Wells Fargo knowingly aided three internet schemes whereby consumers were offered free trials of products only to be charged full price and enrolled in monthly programs. Wells Fargo Knowingly Aided Risk-Free Trial Scams Class Action Lawsuit Alleges. It is believed some banks are levying overdraft fees when their contracts specifically forbid it.

This practice was found to be in violation of California state law. Bank of America and Wells Fargo have already been sued. The judgment against Wells Fargo constituted the 4th largest judgment in California in 2010 and the largest judgment in a class action lawsuit.

The Wells Fargo garnished account class action lawsuit is brought on behalf of all Wells Fargo customers who during the relevant time period had a checking or savings account garnished and were charged overdraft fees for deposits made into the account during the garnishment period. 09-md-02036 in the US. Fill out the form on this page to see if you qualify.

A federal judge has again ordered Wells Fargo to pay 203 million to settle class action litigation accusing it of imposing excessive overdraft fees. The class action lawsuit we filed alleges that wells fargo failed to implement and maintain the proper software and protocols to correctly determine whether a mortgage modification was required under federal regulations. The judge ordered Wells Fargo to return 230 million in unfair bank overdraft fees.

Wells Fargo Company headquartered in San Francisco California is a. Overdraft fee lawsuits such as this one are being filed across. Wells Fargo overdrafts have become big news in the last couple of years.

I believe I may be entitled to some of the class action lawsuit settlement against Wells Fargo. Wells Fargo faces a proposed class action in which the bank stands accused of failing to clearly disclose its overdraft practices to accountholders. Some prominent overdraft fees lawsuits include.

11 In addition to a. There was a report in the Wall Street Journal that stated Wells Fargo had paid out over three-quarters of a billion dollars in overdraft fees to customers in the last three-fourths of a century. Wells Fargo denies any wrongdoing or liability.

To the now-banking giants robot program which the plaintiffs say does nothing but waste money on non-performing loans. In the lawsuit Wallace alleged that Wells Fargo breached its contract with account holders who had not opted in to Wells Fargos overdraft service which promised that Wells Fargo would not charge overdraft fees for non-recurring transactions. A 10536098 Settlement has been reached in a class action lawsuit that alleged that Wells Fargo improperly assessed overdraft fees arising from non-recurring transactions for UberLyft rides by customers who did not opt into Wells Fargos Debit Card Overdraft Service.

They also won a 203 million verdict against Wells Fargo for overdraft fees. Wells Fargo Overdraft Lawsuit. 1 The class-action lawsuit targets a wide array of Wells Fargo policies from the controversial points-of-sale system where homeowners were charged interest on their account balances for balance transfers.

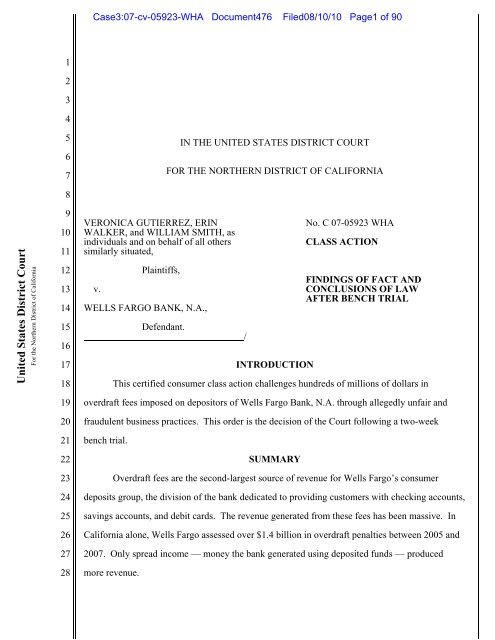

And National General Insurance Company collectively Defendants alleging that between October 15 2005 and September 30 2016 Defendants unlawfully placed collateral protection insurance CPI policies on Class. After hearing evidence in the class-action bank overdraft fee lawsuit Judge Alsup found that Wells Fargo had deliberately manipulated overdraft practices to profiteer off its customers. Collectively Wells Fargo or Defendants in the United States District Court for the Northern District of California styled Veronica Gutierrez Tim Fox.

The case before Judge Alsup was brought on behalf of California Wells Fargo customers who from November 15 2004 to June 30 2008 incurred overdraft fees on debit card transactions as a result of the. District Court for the Southern District of Florida Miami.

Wells Fargo In More Trouble About Overdraft Fees In Garnishments Annuity Dividend Need Cash Now

How To Turn Off Overdraft Protection On Wells Fargo Geniuz Media

How To Get Your Wells Fargo Overdraft Fees Waived A Step By Step Guide

Wells Fargo Letter We Are Discontinuing Personal Lines Of Credit Products Wrinkle Brain Needed R Ddintogme

Wells Fargo Is Trying To Bury Another Massive Scandal The Bank Became Notorious Last Year For Creating Fake Accounts On Behalf Of Customers Now It S Trying To Kill A Class Action Lawsuit

How To Turn Off Overdraft Protection On Wells Fargo Geniuz Media

Wells Fargo Class Action Lawsuit 2021 How To Join Class Action Lawsuit Against Wells Fargo

Wells Fargo S Scandals Just Won T Die

Wells Fargo To Pay 500m To Settle Gap Insurance Fees Class Action Top Class Actions

Wells Fargo Overdraft Fee Claim Review Top Class Actions

Wells Fargo S Unauthorized Accounts Likely Hurt Customers Credit Scores Npr

Wells Fargo Fake Account Scandal Grinds On

First Lawsuit Over Wells Fargo Sales Practices Filed

Wells Fargo Case Findings Of Fact Bank Overdraft Com

Overdraft Lawsuit Claims Wells Fargo Charges Double Fees Top Class Actions

Wells Fargo Robocall Text Spam Class Action Settlement Top Class Actions

Wells Fargo S Scandals Just Won T Die

How To Get Your Wells Fargo Overdraft Fees Waived A Step By Step Guide